nebraska sales tax rate changes

Nebraska has a statewide. New local sales and use taxes.

Ad Keep up with changing tax laws.

. Understand the changing dynamics of sales tax management with our 2022 annual report. The state sales tax rate in Nebraska is 5500. Local sales and use tax rate changes have been announced for Nebraska effective October 1 2015.

NE Sales Tax Calculator. Nebraska Rate and Other Taxability Changes Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Revenue Impact of a Sales Tax Rate Change. A new 1 local sales and use tax is being imposed in the.

Complete Edit or Print Tax Forms Instantly. Average Sales Tax With Local. Because this paper recommends reducing Nebraskas state sales tax rate as part of comprehensive tax reform it would be.

January 2019 sales tax changes. Printable PDF Nebraska Sales Tax Datasheet. Nebraska NE Sales Tax Rates by City.

The local sales and use tax rate in Chadron will increase from 15 to 2. 18 rows Over the past year there have been eighteen local sales tax rate changes in Nebraska. The Nebraska NE state sales tax rate is currently 55.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Ad Access Tax Forms. With local taxes the total sales tax rate is between 5500 and 8000.

Ad Keep up with changing tax laws. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Ad What are the regulatory changes taking place in sales tax that can impact your business.

The Nebraska NE state sales tax rate is currently 55. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Get the Avalara Tax Changes Midyear Update today.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Get the Avalara Tax Changes Midyear Update today. 800-742-7474 NE and IA.

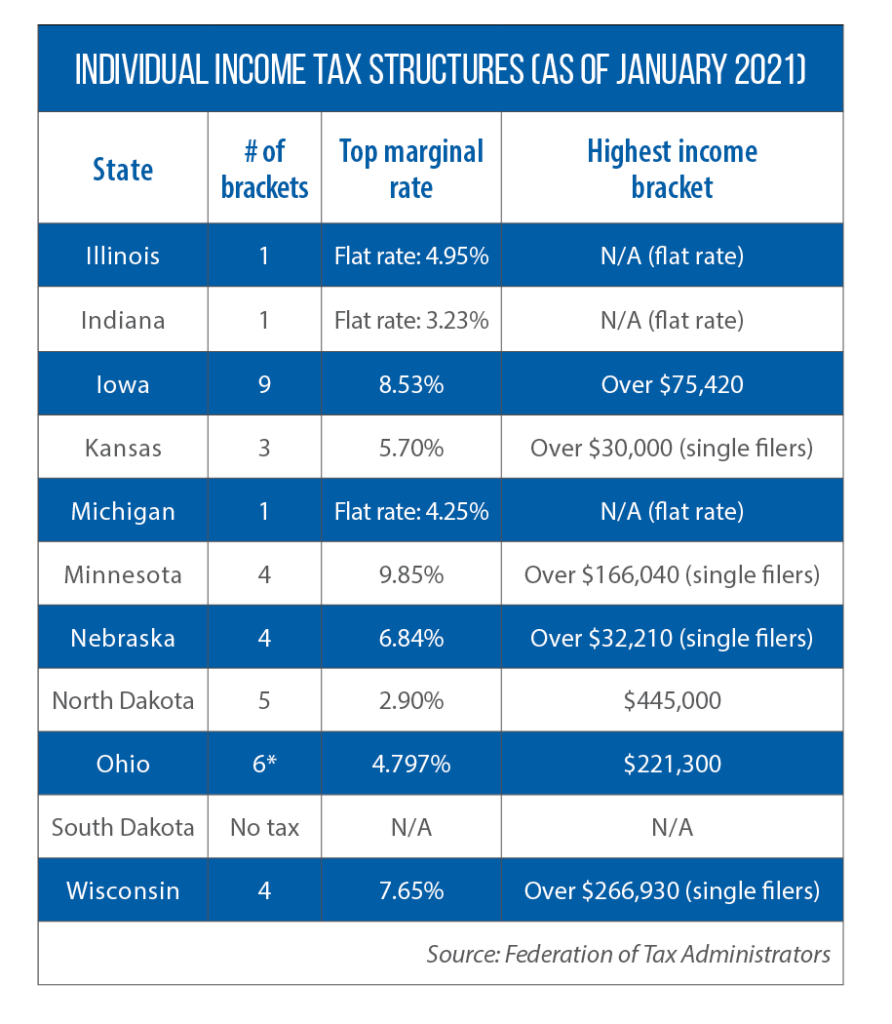

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. Changes in Local Sales and Use Tax Rates Effective January 1 2021. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Motor Fuels Tax Rate.

2024 LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning on or. More are slated for April 1 2019. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax.

Corporate maximum income tax rate change. Nebraska Department of Revenue. Over the past year there have been 22 local sales tax rate changes in Nebraska.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. 536 rows Nebraska Sales Tax55.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. Ad What are the regulatory changes taking place in sales tax that can impact your business. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

The sales tax rate was originally. Understand the changing dynamics of sales tax management with our 2022 annual report. The Nebraska state sales and use tax rate is 55.

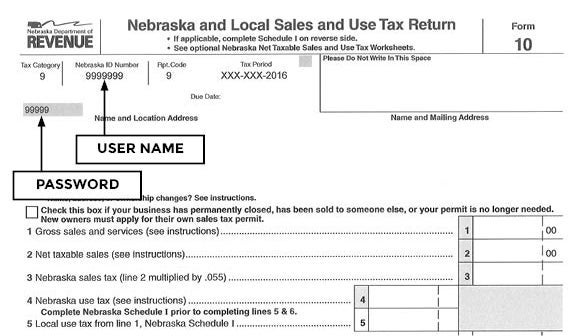

The Nebraska state sales and use tax rate is 55 055.

How High Are Cell Phone Taxes In Your State Tax Foundation

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

General Fund Receipts Nebraska Department Of Revenue

Nebraska Tax Forms And Instructions For 2021 Form 1040n

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Historical Nebraska Tax Policy Information Ballotpedia

Taxes And Spending In Nebraska

With Revenue Growth Strong Iowa Nebraska Ohio And Wisconsin Legislatures Cut Income Taxes In 2021 Csg Midwest

Nebraska Income Tax Calculator Smartasset

2020 Nebraska Property Tax Issues Agricultural Economics

Shawn Wilson Ph D On Twitter 7 States Raised Their Gas Taxes Effective July 1 It S Been Decades Since Louisiana Did That As We Have Lost Value In Little We Pay The Longer

Online Sales And Use Tax Filing Faqs Nebraska Department Of Revenue

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Nebraska Sales Tax Small Business Guide Truic

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare